Repost: Written by me, originally published by Human Network International (HNI)

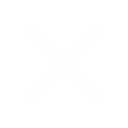

Survey data gathered by HNI’s Mobile to Mobile Survey call center revealed that nearly one in five Malagasy adults don’t understand what taxes are or why the government collects them. Among the most poor surveyed, more than one third did not know.

This and other findings were presented last week by Madagascar’s National Institute of Statistics (INSTAT), Tax Directorate (DGI) and the World Bank on January 26th 2017.

Photo: HNI

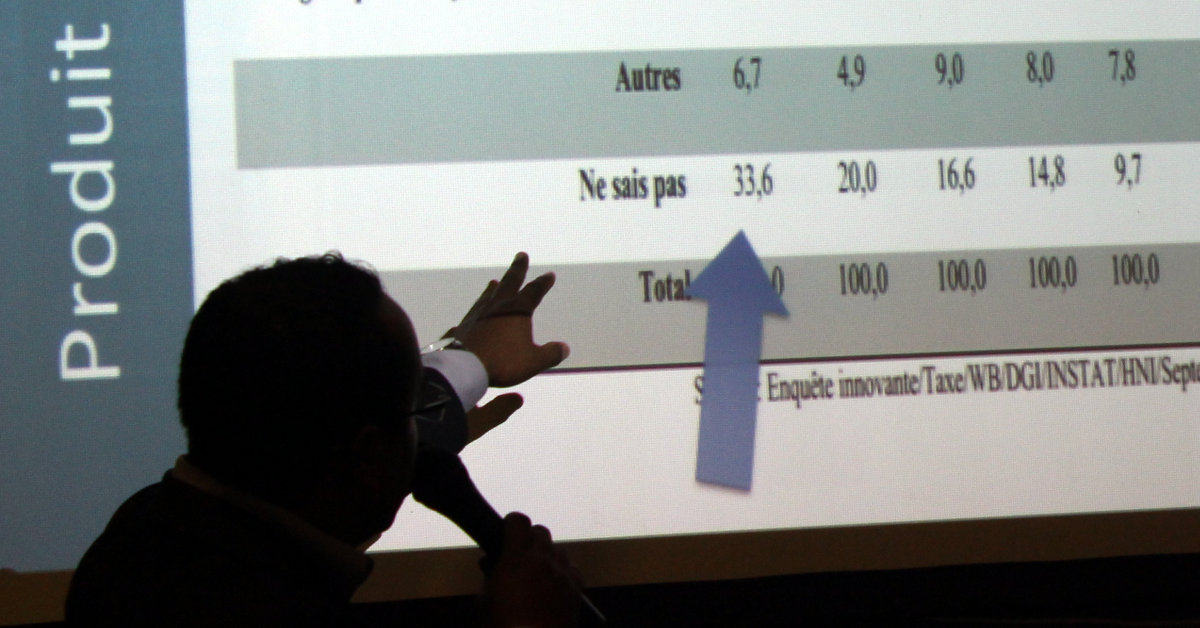

The lack of knowledge about taxes and tax law is the barrier that significantly inhibits many Malagasy citizens from paying taxes ‘ 35.9 percent of adults in Madagascar have never paid taxes.

L-R: Poorest, Poor, Average, Rich, Richest, Overall

HNI’s Mobile to Mobile Survey call center surveys 2000 households every month to support the Listening to Madagascar (L2M) initiative, part of the Bank’s Listening to Africa project.

Our call center make calls to a representative sample of thousands of household in Madagascar. One method used to realize a true representative sample involved providing some of the households with phones and solar chargers in order to charge their mobile phones.

27 January, 2017

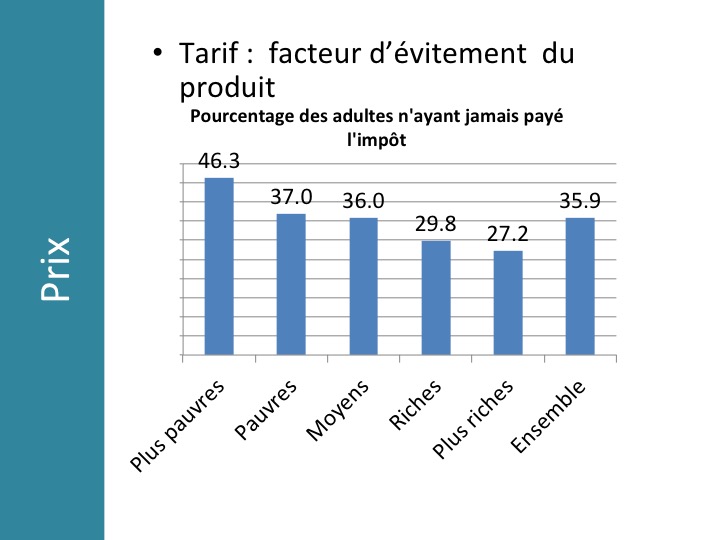

HNI representatives spoke with journalists interested in the survey methodology, and other surveys and statistics that have been produced by Mobile to Mobile Survey call center for L2M.

Photo HNI

Muray Ramahenina, a reporter for Gazetiko, a Malagasy-language newspaper, said that it was really useful having access to the survey data in addition to statistics published by the government. “As an economic journalist,’ Ramahenina said, it is the statistics on economic themes that interest me the most.”

Photo: HNI

Several attendees praised the DGI for its transparency in providing the survey results, and asked that more households surveys and evaluations be carried out. Razafindrakoto Garisse, the head of DGI, said that the department was interested in doing more rounds of surveys.

The interviews conducted by our Mobile to Mobile Survey call center helped the DGI realize the need for an awareness campaign. The campaign will be carried out this year to educate the population about taxes. The objective of the campaign is to promote responsible citizenship, which will increase the amount of citizens and businesses taking action and paying taxes.